Global Car Cameras Market, By Type (Single Channel, Dual Channel), By Application, and By Region - Trends and Forecast Analysis, 2021-2035

Publish Date: 2025-04-09 | Format: PDF | Category: Automotive | Pages: 377

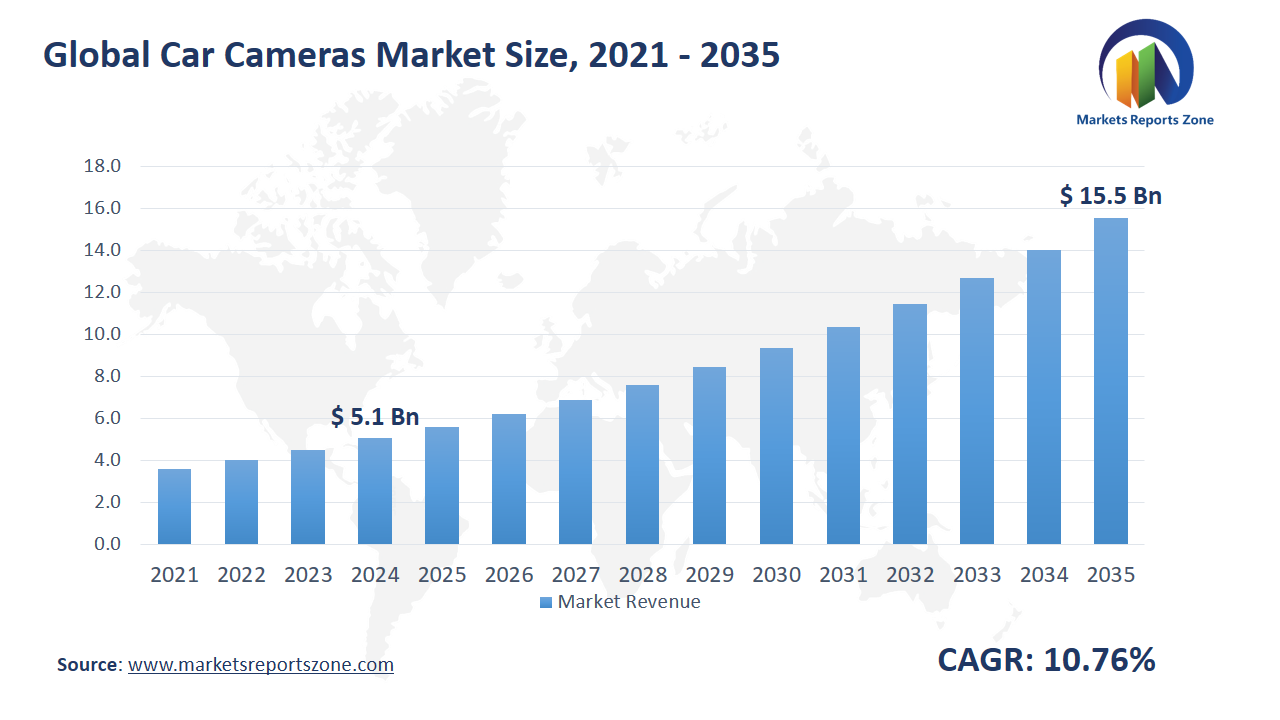

Global Car Cameras Market Size is expected to reach USD 15.56 Billion by 2035 from USD 5.05 Billion in 2024, with a CAGR of around 10.76% between 2024 and 2035. The global car cameras market has been driven by rising concerns over road safety and growing demand for driver-assist features. Cameras have been widely installed to help reduce blind spots, monitor surroundings, and support autonomous functions. Advanced driver assistance systems have relied on real-time imaging for lane detection, collision alerts, and parking assistance. However, high installation and calibration costs have restrained adoption in lower-end vehicle segments, especially in cost-sensitive regions. Some buyers have opted for basic rear-view cameras instead of full 360-degree systems to reduce expenses. Still, opportunities have emerged with government mandates requiring rear-view or dash cameras in many countries, creating steady demand from automakers and fleet operators. Growth in ride-hailing services and logistics has also opened space for multi-camera setups used for in-cabin monitoring and on-road recording. For example, taxi fleets in cities like Singapore and Istanbul have installed dual-camera systems to ensure passenger safety and reduce liability. In electric vehicles, integration of compact and high-resolution cameras has been promoted to support cleaner dashboard designs and external mirrors. These developments have pushed suppliers to improve durability, night vision, and AI-enhanced analytics. As driving environments become more complex, car cameras have been viewed as essential safety and convenience tools.

Driver: Safety Demands Fuel Camera Adoption

Rising concern over road safety has significantly boosted the demand for car cameras across all vehicle segments. As roads become more congested and accidents more frequent, drivers have increasingly relied on cameras for better awareness and control. These devices offer real-time visuals that help in monitoring blind spots, detecting obstacles, and assisting with lane keeping. Many modern cars now come equipped with front, rear, and side-view cameras as part of their standard safety features. In cities where traffic density is high, such as Jakarta or Lagos, drivers often use dash cameras not only for parking support but also to record incidents and avoid false claims. Insurance providers in some areas have started encouraging the use of in-car cameras to help validate accident reports. In school zones and near pedestrian-heavy areas, camera systems play a vital role in alerting drivers to sudden movements and potential collisions. Some parents have even chosen vehicles based on the clarity and range of rear-view camera systems for safer school drop-offs. This growing focus on proactive safety has made camera systems a necessity rather than a luxury. As a result, manufacturers have prioritized integrating them seamlessly into vehicle designs without compromising aesthetics or driving experience.

Key Insights:

- Over 85% of new passenger vehicles produced in Japan included rear-view cameras as a standard feature by the end of 2023.

- A leading global automaker invested $600 million in upgrading its in-house camera manufacturing and AI vision systems for upcoming EV models.

- More than 40 million dash cameras were sold globally in 2022, with strong demand from fleet operators and private car owners.

- Around 65% of commercial fleet vehicles in the U.S. were equipped with multi-camera monitoring systems, including cabin and rear-view units.

- A European car manufacturer reported the use of over 120,000 side-view cameras annually as replacements for traditional mirrors in electric vehicle models.

- Government safety regulations in South Korea led to a 78% penetration rate of backup cameras in new vehicles sold domestically.

- In China, over 30 million front-facing cameras were integrated into advanced driver assistance systems in both passenger and commercial vehicles.

- A major ride-hailing company in Southeast Asia equipped 90% of its fleet with dual-channel dash cams for driver monitoring and incident recording.

Segment Analysis:

The car camera market has grown across both type and application segments, driven by shifting safety norms and user preferences. Single channel cameras, typically mounted on the dashboard, have remained popular among private car owners for their affordability and basic functionality. These cameras are commonly used for recording road incidents and assisting in parking, especially in urban settings. Dual channel cameras, offering both front and rear views, have seen increased adoption among commercial vehicle operators who require full coverage for liability protection and operational monitoring. In light commercial vehicles, such as delivery vans and service fleets, dual channel systems are now used to monitor cargo security and driver behavior. In passenger cars, especially mid-range sedans and family vehicles, buyers have shown growing preference for dual-channel systems for added security and convenience. Heavy commercial vehicles, like buses and logistics trucks, have also integrated advanced dual-camera setups with night vision and wide-angle lenses to assist with maneuvering in tight spaces and loading docks. For instance, tour buses operating in hilly areas have installed rear-view cameras to improve safety on blind turns. As regulations tighten and safety expectations rise, both camera types continue to evolve with better resolution, storage capacity, and AI-driven features tailored to vehicle class and use.

Regional Analysis:

The car camera market has experienced diverse regional growth, shaped by regulatory enforcement, road conditions, and consumer behavior. In North America, rising insurance fraud cases and accident claims have led to increased adoption of dash cams in both personal and commercial vehicles. In cities like Chicago, many rideshare drivers now install dual cameras to document trips for safety and legal protection. Europe has focused on integrating high-resolution cameras into ADAS platforms, especially in Germany and France, where lane-keeping and collision warnings are prioritized. Scandinavian countries have emphasized rugged, all-weather systems suitable for icy conditions. In Asia-Pacific, countries like Thailand and the Philippines have witnessed strong demand from motorcycle courier services, using compact front-facing cams for route tracking and safety. Latin America has seen growing camera usage among bus operators and long-haul truck drivers to monitor road events and support fleet management, particularly in areas with high accident risk. In the Middle East and Africa, dual-camera systems have gained traction in urban taxis and premium SUVs to enhance visibility during night driving and in harsh climates. Across all regions, real-time video streaming and cloud backup capabilities have become essential features, reflecting the global shift toward safety, accountability, and smarter mobility solutions.

Competitive Scenario:

Key players in the car camera market have continued to innovate, expand product lines, and respond to evolving safety demands. Delphi and Continental have focused on integrating car cameras into broader ADAS ecosystems, enabling real-time lane assist and collision avoidance systems in next-gen vehicles. Blackbox Guard and BlackVue have improved low-light and infrared night vision capabilities, catering to both urban drivers and highway travelers. Garmin has enhanced GPS-linked dash cams that sync with mobile apps, offering real-time footage and driver alerts. Papago and Spy Tec have expanded into dual-channel systems for fleets, especially in logistics and courier services. Thinkware has introduced AI-powered cameras that detect drowsiness and lane departures, gaining popularity in commercial fleets. WickedHD and Eken have targeted the budget-conscious consumer segment with compact, wide-angle cameras for daily commuters. Valeo and Clarion have focused on OEM integration, embedding 360-degree surround view cameras in electric and hybrid models. RoadHawk and Transcend have prioritized durability and shockproof designs for off-road and extreme condition driving. Old Shark and KDLINKS have added voice command and emergency-lock features, enhancing user convenience. Together, these developments reflect a shift toward smarter, connected camera systems that go beyond recording, offering active safety and peace of mind on the road.

Car Cameras Market Report Scope

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | USD 5.05 Billion |

| Revenue Forecast in 2035 | USD 15.56 Billion |

| Growth Rate | CAGR of 10.76% from 2025 to 2035 |

| Historic Period | 2021 - 2024 |

| Forecasted Period | 2025 - 2035 |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | U.S.; Canada; Mexico, UK; Germany; France; Spain; Italy; Russia; China; Japan; India; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

| Key companies profiled | Delphi; Continental; Blackbox Guard; BlackVue; Garmin; Papago; Spy Tec; Thinkware; WickedHD; Valeo; Clarion; Eken; RoadHawk; Transcend; Old Shark; KDLINKS |

| Customization | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

The Global Car Cameras Market report is segmented as follows:

By Type,

- Single Channel

- Dual Channel

By Application,

- Passenger Car (PC)

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Region,

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East and Africa

Key Market Players,

- Delphi

- Continental

- Blackbox Guard

- BlackVue

- Garmin

- Papago

- Spy Tec

- Thinkware

- WickedHD

- Valeo

- Clarion

- Eken

- RoadHawk

- Transcend

- Old Shark

- KDLINKS

Frequently Asked Questions

Research Objectives

- Proliferation and maturation of trade in the global Car Cameras Market.

- The market share of the global Car Cameras Market, supply and demand ratio, growth revenue, supply chain analysis, and business overview.

- Current and future market trends that are influencing the growth opportunities and growth rate of the global Car Cameras Market.

- Feasibility study, new market insights, company profiles, investment return, market size of the global Car Cameras Market.

Chapter 1 Car Cameras Market Executive Summary

- 1.1 Car Cameras Market Research Scope

- 1.2 Car Cameras Market Estimates and Forecast (2021-2035)

- 1.2.1 Global Car Cameras Market Value and Growth Rate (2021-2035)

- 1.2.2 Global Car Cameras Market Price Trend (2021-2035)

- 1.3 Global Car Cameras Market Value Comparison, by Type (2021-2035)

- 1.3.1 Single Channel

- 1.3.2 Dual Channel

- 1.4 Global Car Cameras Market Value Comparison, by Application (2021-2035)

- 1.4.1 Passenger Car (PC)

- 1.4.2 Light Commercial Vehicle (LCV)

- 1.4.3 Heavy Commercial Vehicle (HCV)

Chapter 2 Research Methodology

- 2.1 Introduction

- 2.2 Data Capture Sources

- 2.2.1 Primary Sources

- 2.2.2 Secondary Sources

- 2.3 Market Size Estimation

- 2.4 Market Forecast

- 2.5 Assumptions and Limitations

Chapter 3 Market Dynamics

- 3.1 Market Trends

- 3.2 Opportunities and Drivers

- 3.3 Challenges

- 3.4 Market Restraints

- 3.5 Porter's Five Forces Analysis

Chapter 4 Supply Chain Analysis and Marketing Channels

- 4.1 Car Cameras Supply Chain Analysis

- 4.2 Marketing Channels

- 4.3 Car Cameras Suppliers List

- 4.4 Car Cameras Distributors List

- 4.5 Car Cameras Customers

Chapter 5 COVID-19 & Russia?Ukraine War Impact Analysis

- 5.1 COVID-19 Impact Analysis on Car Cameras Market

- 5.2 Russia-Ukraine War Impact Analysis on Car Cameras Market

Chapter 6 Car Cameras Market Estimate and Forecast by Region

- 6.1 Global Car Cameras Market Value by Region: 2021 VS 2023 VS 2035

- 6.2 Global Car Cameras Market Scenario by Region (2021-2023)

- 6.2.1 Global Car Cameras Market Value Share by Region (2021-2023)

- 6.3 Global Car Cameras Market Forecast by Region (2024-2035)

- 6.3.1 Global Car Cameras Market Value Forecast by Region (2024-2035)

- 6.4 Geographic Market Analysis: Market Facts and Figures

- 6.4.1 North America Car Cameras Market Estimates and Projections (2021-2035)

- 6.4.2 Europe Car Cameras Market Estimates and Projections (2021-2035)

- 6.4.3 Asia Pacific Car Cameras Market Estimates and Projections (2021-2035)

- 6.4.4 Latin America Car Cameras Market Estimates and Projections (2021-2035)

- 6.4.5 Middle East & Africa Car Cameras Market Estimates and Projections (2021-2035)

Chapter 7 Global Car Cameras Competition Landscape by Players

- 7.1 Global Top Car Cameras Players by Value (2021-2023)

- 7.2 Car Cameras Headquarters and Sales Region by Company

- 7.3 Company Recent Developments, Mergers & Acquisitions, and Expansion Plans

Chapter 8 Global Car Cameras Market, by Type

- 8.1 Global Car Cameras Market Value, by Type (2021-2035)

- 8.1.1 Single Channel

- 8.1.2 Dual Channel

Chapter 9 Global Car Cameras Market, by Application

- 9.1 Global Car Cameras Market Value, by Application (2021-2035)

- 9.1.1 Passenger Car (PC)

- 9.1.2 Light Commercial Vehicle (LCV)

- 9.1.3 Heavy Commercial Vehicle (HCV)

Chapter 10 North America Car Cameras Market

- 10.1 Overview

- 10.2 North America Car Cameras Market Value, by Country (2021-2035)

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 North America Car Cameras Market Value, by Type (2021-2035)

- 10.3.1 Single Channel

- 10.3.2 Dual Channel

- 10.4 North America Car Cameras Market Value, by Application (2021-2035)

- 10.4.1 Passenger Car (PC)

- 10.4.2 Light Commercial Vehicle (LCV)

- 10.4.3 Heavy Commercial Vehicle (HCV)

Chapter 11 Europe Car Cameras Market

- 11.1 Overview

- 11.2 Europe Car Cameras Market Value, by Country (2021-2035)

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Spain

- 11.2.5 Italy

- 11.2.6 Russia

- 11.2.7 Rest of Europe

- 11.3 Europe Car Cameras Market Value, by Type (2021-2035)

- 11.3.1 Single Channel

- 11.3.2 Dual Channel

- 11.4 Europe Car Cameras Market Value, by Application (2021-2035)

- 11.4.1 Passenger Car (PC)

- 11.4.2 Light Commercial Vehicle (LCV)

- 11.4.3 Heavy Commercial Vehicle (HCV)

Chapter 12 Asia Pacific Car Cameras Market

- 12.1 Overview

- 12.2 Asia Pacific Car Cameras Market Value, by Country (2021-2035)

- 12.2.1 China

- 12.2.2 Japan

- 12.2.3 India

- 12.2.4 South Korea

- 12.2.5 Australia

- 12.2.6 Southeast Asia

- 12.2.7 Rest of Asia Pacific

- 12.3 Asia Pacific Car Cameras Market Value, by Type (2021-2035)

- 12.3.1 Single Channel

- 12.3.2 Dual Channel

- 12.4 Asia Pacific Car Cameras Market Value, by Application (2021-2035)

- 12.4.1 Passenger Car (PC)

- 12.4.2 Light Commercial Vehicle (LCV)

- 12.4.3 Heavy Commercial Vehicle (HCV)

Chapter 13 Latin America Car Cameras Market

- 13.1 Overview

- 13.2 Latin America Car Cameras Market Value, by Country (2021-2035)

- 13.2.1 Brazil

- 13.2.2 Argentina

- 13.2.3 Rest of Latin America

- 13.3 Latin America Car Cameras Market Value, by Type (2021-2035)

- 13.3.1 Single Channel

- 13.3.2 Dual Channel

- 13.4 Latin America Car Cameras Market Value, by Application (2021-2035)

- 13.4.1 Passenger Car (PC)

- 13.4.2 Light Commercial Vehicle (LCV)

- 13.4.3 Heavy Commercial Vehicle (HCV)

Chapter 14 Middle East & Africa Car Cameras Market

- 14.1 Overview

- 14.2 Middle East & Africa Car Cameras Market Value, by Country (2021-2035)

- 14.2.1 Saudi Arabia

- 14.2.2 UAE

- 14.2.3 South Africa

- 14.2.4 Rest of Middle East & Africa

- 14.3 Middle East & Africa Car Cameras Market Value, by Type (2021-2035)

- 14.3.1 Single Channel

- 14.3.2 Dual Channel

- 14.4 Middle East & Africa Car Cameras Market Value, by Application (2021-2035)

- 14.4.1 Passenger Car (PC)

- 14.4.2 Light Commercial Vehicle (LCV)

- 14.4.3 Heavy Commercial Vehicle (HCV)

Chapter 15 Company Profiles and Market Share Analysis: (Business Overview, Market Share Analysis, Products/Services Offered, Recent Developments)

- 15.1 Delphi

- 15.2 Continental

- 15.3 Blackbox Guard

- 15.4 BlackVue

- 15.5 Garmin

- 15.6 Papago

- 15.7 Spy Tec

- 15.8 Thinkware

- 15.9 WickedHD

- 15.10 Valeo

- 15.11 Clarion

- 15.12 Eken

- 15.13 RoadHawk

- 15.14 Transcend

- 15.15 Old Shark

- 15.16 KDLINKS

Report ID:

108

Published Date:

April 2025

Trusted by more than 10,500 organizations globally

Infaluble Methodology

Customization

Analyst Support

Targeted Market View