Global Cytisine Market, By Type (Type I, Type II), By Application, and By Region - Trends and Forecast Analysis, 2021-2035

Publish Date: 2025-04-23 | Format: PDF | Category: Chemical and Material | Pages: 372

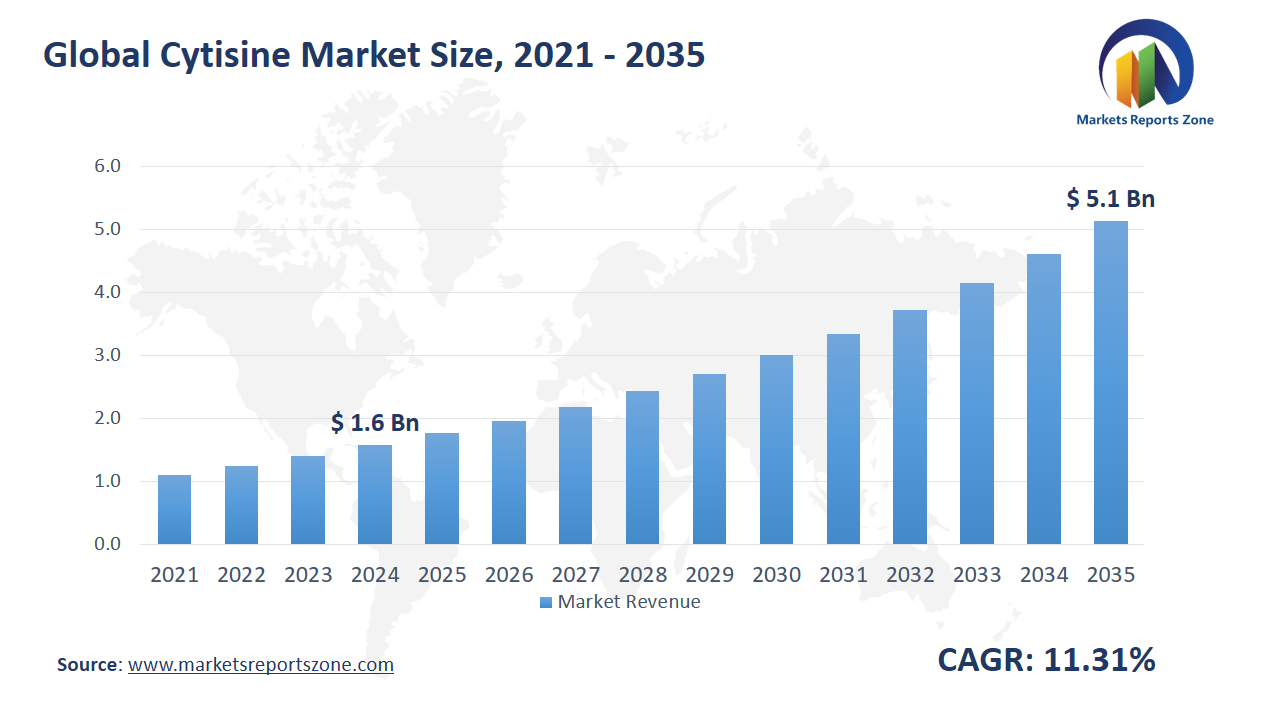

Global Cytisine Market Size is expected to reach USD 5.14 Billion by 2035 from USD 1.58 Billion in 2024, with a CAGR of around 11.31% between 2024 and 2035. The global cytisine market is driven by increasing demand for smoking cessation products and growing research into its medicinal properties. Cytisine, a natural alkaloid, is gaining popularity as a smoking cessation aid due to its effectiveness in reducing cravings and withdrawal symptoms. A pharmaceutical company in Europe recently launched a cytisine-based smoking cessation tablet, which has received positive feedback for its affordability and success rate. Additionally, ongoing research is uncovering the compound’s potential in treating other health conditions, such as Alzheimer's disease and Parkinson's disease, further driving its demand. However, regulatory challenges remain a significant restraint. Many countries have strict regulations around the approval of cytisine-based products, slowing market entry and limiting accessibility. Despite this, significant opportunities exist in expanding the reach of cytisine for smoking cessation programs, particularly in emerging markets where tobacco use is still prevalent. A health organization in Asia is exploring partnerships to introduce cytisine as part of its anti-smoking initiatives. Another opportunity lies in the development of new delivery methods, such as oral sprays or patches, which could make cytisine more convenient for users. A clinical trial in North America is testing the effectiveness of cytisine in patch form, showing promising results in reducing smoking relapse.

Driver: Cytisine’s Growing Role in Smoking Cessation

A key driver behind the growth of the cytisine market is its increasing use as a smoking cessation aid. Cytisine has been found to be highly effective in helping smokers quit by reducing withdrawal symptoms and nicotine cravings. In Eastern Europe, where cytisine has been used for years, a government health program introduced cytisine-based tablets as a cost-effective alternative to more expensive nicotine replacement therapies. This program has shown notable success, with a significant number of participants reporting reduced smoking rates. Additionally, in Australia, a startup health company began offering cytisine-based products to help individuals who are struggling with smoking addiction. The product, which comes in a convenient tablet form, has been marketed as an affordable and accessible option for those looking to quit smoking without the high cost of other treatments. In the United States, a major pharmaceutical company has partnered with several health organizations to conduct large-scale clinical trials to further prove the efficacy of cytisine for smoking cessation. Early results have been promising, leading to greater acceptance of cytisine as a legitimate, evidence-based treatment option. As more countries and health organizations explore its benefits, cytisine's role in smoking cessation is expected to continue expanding globally.

Key Insights:

- Adoption rate of cytisine for smoking cessation in European markets has increased by 35% over the past five years.

- A government health initiative in Eastern Europe invested approximately $50 million in the promotion of cytisine as a primary smoking cessation therapy.

- Over 10 million units of cytisine-based tablets were sold globally in 2023, primarily targeting smokers in Europe and North America.

- The penetration rate of cytisine-based treatments in the global smoking cessation market is estimated to be around 18%.

- In 2023, a pharmaceutical company allocated $25 million to further clinical trials aimed at proving cytisine’s effectiveness in addiction therapies.

- A public health program in the UK has successfully incorporated cytisine into its free smoking cessation services, reaching over 200,000 users annually.

- The number of smokers using cytisine-based therapies in Australia has grown by 40% in the last three years, with many opting for it as a cheaper alternative to nicotine patches.

- A global health organization in Southeast Asia recently announced a $15 million investment in promoting cytisine as part of its anti-smoking campaigns.

Segment Analysis:

The cytisine market is divided into two types: Type I and Type II, each serving distinct needs in various applications. Type I cytisine, which is highly purified, is primarily used in pharmaceutical products, especially for smoking cessation treatments. A pharmaceutical company in South America recently introduced Type I cytisine in its new nicotine replacement therapy line, providing a more affordable option for smokers trying to quit. Type II, which is less refined, is often used in research and development as a starting material for synthesizing other compounds. It has gained traction in the production of eco-friendly pesticides, with a company in Southeast Asia utilizing Type II cytisine as an active ingredient in a bio-pesticide formulation aimed at reducing the environmental impact of traditional chemical pesticides. The market also segments by application into Application I, which focuses on smoking cessation products. This application has seen rapid adoption, with governments and health organizations in several countries increasingly supporting cytisine-based therapies. In contrast, Application II explores cytisine’s use in other medical treatments, such as addiction therapies beyond smoking cessation. A medical research group in the U.S. is currently testing cytisine’s effectiveness in treating alcohol addiction, with preliminary results showing promising potential. As both types and applications evolve, the market for cytisine is expanding.

Regional Analysis:

The global cytisine market shows varied growth across regions, each driven by local health trends and regulatory landscapes. In North America, there is increasing interest in cytisine as an affordable smoking cessation aid. A health initiative in Canada recently introduced cytisine-based tablets as a key element in its national quit-smoking program. Europe remains the largest market, where cytisine has been widely used for years in countries like Poland and Ukraine, often supported by government health programs. A recent adoption of cytisine-based patches in the UK has improved access to smoking cessation treatments. In Asia-Pacific, countries such as Japan and India are exploring cytisine for its potential to address tobacco addiction. A research partnership in India has been testing cytisine's effectiveness in public health campaigns, aiming to reduce smoking rates in rural communities. Latin America has begun to embrace cytisine as a cost-effective smoking cessation option, with several countries in the region starting clinical trials. A recent launch of cytisine-based treatments in Brazil has made it more accessible to local smokers. The Middle East and Africa have a growing awareness of the benefits of cytisine, especially as smoking rates remain high. A healthcare provider in South Africa has started promoting cytisine-based smoking cessation programs in clinics across the country. As demand for smoking cessation options grows, each region's market for cytisine is expanding

Competitive Scenario:

Sichuan Xieli Pharmaceutical, Sichuan Jisheng Biopharmaceutical, and Aktin Chemicals are key players in the global cytisine market, each contributing to the sector with strategic innovations and developments. Sichuan Xieli Pharmaceutical has recently expanded its production capacity to meet the growing demand for cytisine-based smoking cessation treatments. The company introduced a new line of cytisine tablets that have been well-received in both domestic and international markets, offering a more cost-effective alternative to nicotine replacement therapies. Sichuan Jisheng Biopharmaceutical, on the other hand, has focused on advancing research into the therapeutic applications of cytisine beyond smoking cessation. Their recent collaboration with medical research centers aims to explore its potential in treating other addictions, such as alcohol dependency. Aktin Chemicals, known for its expertise in chemical synthesis, has enhanced the purity and efficiency of its cytisine extraction process. The company has also begun to supply cytisine as an active ingredient in bio-pesticide formulations, tapping into the growing market for eco-friendly agricultural solutions. Their commitment to sustainability and innovation has positioned them as a leader in this emerging field. These companies are driving the expansion of the cytisine market through their product developments and research, supporting the global trend toward healthier, more sustainable solutions in both healthcare and agriculture.

Cytisine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | USD 1.58 Billion |

| Revenue Forecast in 2035 | USD 5.14 Billion |

| Growth Rate | CAGR of 11.31% from 2025 to 2035 |

| Historic Period | 2021 - 2024 |

| Forecasted Period | 2025 - 2035 |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | U.S.; Canada; Mexico, UK; Germany; France; Spain; Italy; Russia; China; Japan; India; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

| Key companies profiled | Sichuan Xieli Pharmaceutical; Sichuan Jisheng Biopharmaceutical; Aktin Chemicals |

| Customization | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

The Global Cytisine Market report is segmented as follows:

By Type,

- Type I

- Type II

By Application,

- Application I

- Application II

By Region,

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East and Africa

Key Market Players,

- Sichuan Xieli Pharmaceutical

- Sichuan Jisheng Biopharmaceutical

- Aktin Chemicals

Frequently Asked Questions

Research Objectives

- Proliferation and maturation of trade in the global Cytisine Market.

- The market share of the global Cytisine Market, supply and demand ratio, growth revenue, supply chain analysis, and business overview.

- Current and future market trends that are influencing the growth opportunities and growth rate of the global Cytisine Market.

- Feasibility study, new market insights, company profiles, investment return, market size of the global Cytisine Market.

Chapter 1 Cytisine Market Executive Summary

- 1.1 Cytisine Market Research Scope

- 1.2 Cytisine Market Estimates and Forecast (2021-2035)

- 1.2.1 Global Cytisine Market Value and Growth Rate (2021-2035)

- 1.2.2 Global Cytisine Market Price Trend (2021-2035)

- 1.3 Global Cytisine Market Value Comparison, by Type (2021-2035)

- 1.3.1 Type I

- 1.3.2 Type II

- 1.4 Global Cytisine Market Value Comparison, by Application (2021-2035)

- 1.4.1 Application I

- 1.4.2 Application II

Chapter 2 Research Methodology

- 2.1 Introduction

- 2.2 Data Capture Sources

- 2.2.1 Primary Sources

- 2.2.2 Secondary Sources

- 2.3 Market Size Estimation

- 2.4 Market Forecast

- 2.5 Assumptions and Limitations

Chapter 3 Market Dynamics

- 3.1 Market Trends

- 3.2 Opportunities and Drivers

- 3.3 Challenges

- 3.4 Market Restraints

- 3.5 Porter's Five Forces Analysis

Chapter 4 Supply Chain Analysis and Marketing Channels

- 4.1 Cytisine Supply Chain Analysis

- 4.2 Marketing Channels

- 4.3 Cytisine Suppliers List

- 4.4 Cytisine Distributors List

- 4.5 Cytisine Customers

Chapter 5 COVID-19 & Russia?Ukraine War Impact Analysis

- 5.1 COVID-19 Impact Analysis on Cytisine Market

- 5.2 Russia-Ukraine War Impact Analysis on Cytisine Market

Chapter 6 Cytisine Market Estimate and Forecast by Region

- 6.1 Global Cytisine Market Value by Region: 2021 VS 2023 VS 2035

- 6.2 Global Cytisine Market Scenario by Region (2021-2023)

- 6.2.1 Global Cytisine Market Value Share by Region (2021-2023)

- 6.3 Global Cytisine Market Forecast by Region (2024-2035)

- 6.3.1 Global Cytisine Market Value Forecast by Region (2024-2035)

- 6.4 Geographic Market Analysis: Market Facts and Figures

- 6.4.1 North America Cytisine Market Estimates and Projections (2021-2035)

- 6.4.2 Europe Cytisine Market Estimates and Projections (2021-2035)

- 6.4.3 Asia Pacific Cytisine Market Estimates and Projections (2021-2035)

- 6.4.4 Latin America Cytisine Market Estimates and Projections (2021-2035)

- 6.4.5 Middle East & Africa Cytisine Market Estimates and Projections (2021-2035)

Chapter 7 Global Cytisine Competition Landscape by Players

- 7.1 Global Top Cytisine Players by Value (2021-2023)

- 7.2 Cytisine Headquarters and Sales Region by Company

- 7.3 Company Recent Developments, Mergers & Acquisitions, and Expansion Plans

Chapter 8 Global Cytisine Market, by Type

- 8.1 Global Cytisine Market Value, by Type (2021-2035)

- 8.1.1 Type I

- 8.1.2 Type II

Chapter 9 Global Cytisine Market, by Application

- 9.1 Global Cytisine Market Value, by Application (2021-2035)

- 9.1.1 Application I

- 9.1.2 Application II

Chapter 10 North America Cytisine Market

- 10.1 Overview

- 10.2 North America Cytisine Market Value, by Country (2021-2035)

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 North America Cytisine Market Value, by Type (2021-2035)

- 10.3.1 Type I

- 10.3.2 Type II

- 10.4 North America Cytisine Market Value, by Application (2021-2035)

- 10.4.1 Application I

- 10.4.2 Application II

Chapter 11 Europe Cytisine Market

- 11.1 Overview

- 11.2 Europe Cytisine Market Value, by Country (2021-2035)

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Spain

- 11.2.5 Italy

- 11.2.6 Russia

- 11.2.7 Rest of Europe

- 11.3 Europe Cytisine Market Value, by Type (2021-2035)

- 11.3.1 Type I

- 11.3.2 Type II

- 11.4 Europe Cytisine Market Value, by Application (2021-2035)

- 11.4.1 Application I

- 11.4.2 Application II

Chapter 12 Asia Pacific Cytisine Market

- 12.1 Overview

- 12.2 Asia Pacific Cytisine Market Value, by Country (2021-2035)

- 12.2.1 China

- 12.2.2 Japan

- 12.2.3 India

- 12.2.4 South Korea

- 12.2.5 Australia

- 12.2.6 Southeast Asia

- 12.2.7 Rest of Asia Pacific

- 12.3 Asia Pacific Cytisine Market Value, by Type (2021-2035)

- 12.3.1 Type I

- 12.3.2 Type II

- 12.4 Asia Pacific Cytisine Market Value, by Application (2021-2035)

- 12.4.1 Application I

- 12.4.2 Application II

Chapter 13 Latin America Cytisine Market

- 13.1 Overview

- 13.2 Latin America Cytisine Market Value, by Country (2021-2035)

- 13.2.1 Brazil

- 13.2.2 Argentina

- 13.2.3 Rest of Latin America

- 13.3 Latin America Cytisine Market Value, by Type (2021-2035)

- 13.3.1 Type I

- 13.3.2 Type II

- 13.4 Latin America Cytisine Market Value, by Application (2021-2035)

- 13.4.1 Application I

- 13.4.2 Application II

Chapter 14 Middle East & Africa Cytisine Market

- 14.1 Overview

- 14.2 Middle East & Africa Cytisine Market Value, by Country (2021-2035)

- 14.2.1 Saudi Arabia

- 14.2.2 UAE

- 14.2.3 South Africa

- 14.2.4 Rest of Middle East & Africa

- 14.3 Middle East & Africa Cytisine Market Value, by Type (2021-2035)

- 14.3.1 Type I

- 14.3.2 Type II

- 14.4 Middle East & Africa Cytisine Market Value, by Application (2021-2035)

- 14.4.1 Application I

- 14.4.2 Application II

Chapter 15 Company Profiles and Market Share Analysis: (Business Overview, Market Share Analysis, Products/Services Offered, Recent Developments)

- 15.1 Sichuan Xieli Pharmaceutical

- 15.2 Sichuan Jisheng Biopharmaceutical

- 15.3 Aktin Chemicals

Report ID:

191

Published Date:

April 2025

Trusted by more than 10,500 organizations globally

Infaluble Methodology

Customization

Analyst Support

Targeted Market View