Global Medical Polypropylene Market, By Type (Type I, Type II), By Application, and By Region - Trends and Forecast Analysis, 2021-2035

Publish Date: 2025-04-12 | Format: PDF | Category: Chemical and Material | Pages: 326

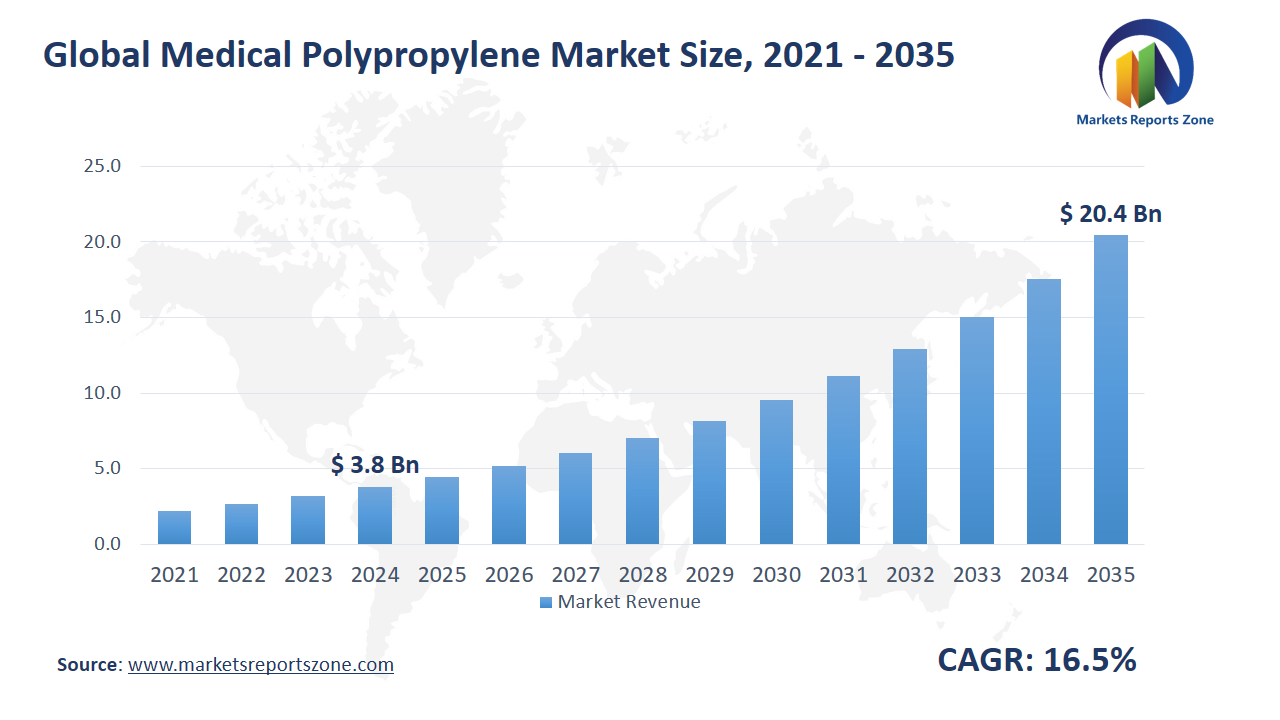

Global Medical Polypropylene Market Size is expected to reach USD 20.49 Billion by 2035 from USD 3.81 Billion in 2024, with a CAGR of around 16.5% between 2024 and 2035. The global medical polypropylene market has been propelled by two primary drivers. Firstly, the increasing demand for sustainable and bio-based materials in medical devices has led to the adoption of bio-based polypropylene, derived from renewable sources like biomass. This shift aligns with the healthcare industry's emphasis on eco-friendly practices and reducing environmental impact. Secondly, advancements in bio-based polypropylene technology, such as improved catalytic processes and enhanced bio-feedstock formulations, have made production more efficient and cost-effective, broadening its applications in medical packaging, surgical tools, and diagnostic devices. However, a significant restraint is the higher production cost of bio-based polypropylene compared to conventional fossil-based polypropylene, which can limit its adoption in budget-sensitive markets and smaller healthcare institutions. Despite this, opportunities have emerged. One is the rising demand for sustainable and bio-based materials in medical devices, driven by regulatory requirements and consumer preferences for green products. Another opportunity lies in the advancement of bio-based polypropylene technology, enabling the development of innovative medical devices that meet clinical requirements and environmental standards. For instance, in December 2023, LyondellBasell and Pigeon Singapore partnered to enhance the sustainability of baby nursing bottles by incorporating bio-based polypropylene polymers, moving away from 100% virgin polypropylene resins. Such initiatives exemplify the market's potential for growth and innovation.

Driver: Bio-Based Shift in Healthcare Plastics

A strong push toward eco-friendly materials has been seen in the healthcare industry, driving adoption of bio-based polypropylene. Hospitals and clinics have been pressured to reduce their environmental impact, especially in waste-heavy departments like surgery and diagnostics. Bio-based polypropylene, derived from renewable sources such as sugarcane or corn, has been introduced as a greener alternative to traditional plastics. Its ability to maintain the same durability and sterility standards has made it suitable for syringes, IV components, and specimen containers. In several European clinics, disposable surgical trays made with bio-based polypropylene have replaced conventional trays to support green initiatives. Medical packaging suppliers have also shifted, offering blister packs and caps made from bio-resins that mimic the strength and heat resistance of fossil-based materials. Healthcare startups have promoted their commitment to sustainability by branding their equipment as “plant-powered,” attracting environmentally conscious clients. Even some dental product companies have begun using bio-based materials in items like suction tips and molds. This shift has not only reduced dependency on petrochemicals but also created new marketing advantages. With regulations favoring lower carbon materials, the use of bio-based polypropylene in medical settings is expected to increase steadily, offering both functional and environmental value.

Key Insights:

- The adoption rate of bio-based polypropylene in medical applications has reached 25% globally over the past five years.

- Over 500,000 tons of polypropylene were used in medical packaging materials last year alone.

- The medical polypropylene segment is seeing a penetration rate of 30% in the global healthcare packaging industry.

- In 2023, a major polypropylene manufacturer invested USD 75 million in expanding its medical-grade polypropylene production capabilities.

- Approximately 200,000 units of polypropylene-based medical devices, such as syringes and IV components, were shipped globally in the past year.

- The medical polypropylene market in Europe has witnessed a growth rate of 18% annually over the last three years, driven by increasing demand for sustainable medical packaging.

- Companies in North America have focused investments of USD 50 million into R&D for producing higher-quality, biocompatible polypropylene for medical device applications.

- In Asia, the adoption of medical polypropylene for injection molding applications has reached a 40% share of the total market.

Segment Analysis:

The global polypropylene market is segmented into two main types—Type I and Type II—each catering to specific needs. Type I, known for its enhanced durability and resistance to chemical degradation, is widely used in medical applications, particularly in the production of sterile packaging for drugs and medical devices. Its resistance to high temperatures makes it ideal for autoclaving, and it has been used extensively in the production of syringes and surgical instruments. Type II, on the other hand, is preferred in industries where flexibility and light weight are prioritized. It has been applied in the production of medical textiles like surgical drapes and gowns, where comfort and ease of movement are crucial. The market is also divided by application. Application I includes the use of polypropylene in medical device manufacturing, such as infusion pumps and diagnostic equipment, where precision and stability are required. For example, several leading hospitals use polypropylene-based components for their high-performance medical devices. Application II refers to its use in packaging materials, such as pill bottles, vials, and blister packs, where it is valued for its cost-effectiveness and ability to maintain product integrity over time. Companies in the pharmaceutical and healthcare sectors continue to adopt both types to meet evolving industry demands.

Regional Analysis:

The global medical polypropylene market exhibits distinct trends across five major regions. In North America, the U.S. has been a major player, particularly in medical packaging, where polypropylene is widely used for sterile packaging of drugs, syringes, and surgical instruments. The growing healthcare sector, driven by advancements in medical technologies, has significantly boosted demand. In Europe, countries like Germany and France have embraced polypropylene for medical devices and packaging, especially in the pharmaceutical industry. Hospitals and healthcare facilities use polypropylene-based products for their durability and cost-effectiveness. In the Asia-Pacific region, the demand for medical polypropylene is rapidly growing, driven by the expansion of healthcare infrastructure in countries like China and India. The increasing number of medical procedures and the rising population have further pushed the need for polypropylene in medical applications. Latin America, particularly Brazil and Mexico, has shown a rise in medical polypropylene usage in packaging and disposable medical devices as healthcare standards improve. The Middle East & Africa is emerging as a growing market for medical polypropylene, with investments in healthcare infrastructure increasing, particularly in countries like Saudi Arabia. The use of polypropylene in medical applications is expanding due to its versatility, sterility, and cost-effectiveness, contributing to regional market growth.

Competitive Scenario:

The medical polypropylene market has experienced significant advancements, propelled by key industry players such as Proxy Biomedical, Dow, DuPont, BASF, and Lanxess. Proxy Biomedical has introduced innovative bio-based polypropylene compounds, enhancing the sustainability of medical devices. Dow has expanded its portfolio with medical-grade polypropylene suitable for injection molding, addressing the growing demand for disposable medical products. DuPont has launched new grades of bio-based polypropylene, aiming to reduce environmental impact without compromising performance in medical applications. BASF has developed advanced polypropylene compounds for medical packaging, focusing on sterility and patient safety. Lanxess has introduced high-performance polypropylene materials for surgical instruments, emphasizing precision and reliability. These developments underscore the industry's commitment to innovation and sustainability, meeting the evolving needs of the medical sector.

Medical Polypropylene Market Report Scope

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | USD 3.81 Billion |

| Revenue Forecast in 2035 | USD 20.49 Billion |

| Growth Rate | CAGR of 16.5% from 2025 to 2035 |

| Historic Period | 2021 - 2024 |

| Forecasted Period | 2025 - 2035 |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | U.S.; Canada; Mexico, UK; Germany; France; Spain; Italy; Russia; China; Japan; India; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

| Key companies profiled | Proxy Biomedical; Dow; DuPont; Basf; Lanxess |

| Customization | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

The Global Medical Polypropylene Market report is segmented as follows:

By Type,

- Type I

- Type II

By Application,

- Application I

- Application II

By Region,

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East and Africa

Key Market Players,

- Proxy Biomedical

- Dow

- DuPont

- Basf

- Lanxess

Frequently Asked Questions

Research Objectives

- Proliferation and maturation of trade in the global Medical Polypropylene Market.

- The market share of the global Medical Polypropylene Market, supply and demand ratio, growth revenue, supply chain analysis, and business overview.

- Current and future market trends that are influencing the growth opportunities and growth rate of the global Medical Polypropylene Market.

- Feasibility study, new market insights, company profiles, investment return, market size of the global Medical Polypropylene Market.

Chapter 1 Medical Polypropylene Market Executive Summary

- 1.1 Medical Polypropylene Market Research Scope

- 1.2 Medical Polypropylene Market Estimates and Forecast (2021-2035)

- 1.2.1 Global Medical Polypropylene Market Value and Growth Rate (2021-2035)

- 1.2.2 Global Medical Polypropylene Market Price Trend (2021-2035)

- 1.3 Global Medical Polypropylene Market Value Comparison, by Type (2021-2035)

- 1.3.1 Type I

- 1.3.2 Type II

- 1.4 Global Medical Polypropylene Market Value Comparison, by Application (2021-2035)

- 1.4.1 Application I

- 1.4.2 Application II

Chapter 2 Research Methodology

- 2.1 Introduction

- 2.2 Data Capture Sources

- 2.2.1 Primary Sources

- 2.2.2 Secondary Sources

- 2.3 Market Size Estimation

- 2.4 Market Forecast

- 2.5 Assumptions and Limitations

Chapter 3 Market Dynamics

- 3.1 Market Trends

- 3.2 Opportunities and Drivers

- 3.3 Challenges

- 3.4 Market Restraints

- 3.5 Porter's Five Forces Analysis

Chapter 4 Supply Chain Analysis and Marketing Channels

- 4.1 Medical Polypropylene Supply Chain Analysis

- 4.2 Marketing Channels

- 4.3 Medical Polypropylene Suppliers List

- 4.4 Medical Polypropylene Distributors List

- 4.5 Medical Polypropylene Customers

Chapter 5 COVID-19 & Russia?Ukraine War Impact Analysis

- 5.1 COVID-19 Impact Analysis on Medical Polypropylene Market

- 5.2 Russia-Ukraine War Impact Analysis on Medical Polypropylene Market

Chapter 6 Medical Polypropylene Market Estimate and Forecast by Region

- 6.1 Global Medical Polypropylene Market Value by Region: 2021 VS 2023 VS 2035

- 6.2 Global Medical Polypropylene Market Scenario by Region (2021-2023)

- 6.2.1 Global Medical Polypropylene Market Value Share by Region (2021-2023)

- 6.3 Global Medical Polypropylene Market Forecast by Region (2024-2035)

- 6.3.1 Global Medical Polypropylene Market Value Forecast by Region (2024-2035)

- 6.4 Geographic Market Analysis: Market Facts and Figures

- 6.4.1 North America Medical Polypropylene Market Estimates and Projections (2021-2035)

- 6.4.2 Europe Medical Polypropylene Market Estimates and Projections (2021-2035)

- 6.4.3 Asia Pacific Medical Polypropylene Market Estimates and Projections (2021-2035)

- 6.4.4 Latin America Medical Polypropylene Market Estimates and Projections (2021-2035)

- 6.4.5 Middle East & Africa Medical Polypropylene Market Estimates and Projections (2021-2035)

Chapter 7 Global Medical Polypropylene Competition Landscape by Players

- 7.1 Global Top Medical Polypropylene Players by Value (2021-2023)

- 7.2 Medical Polypropylene Headquarters and Sales Region by Company

- 7.3 Company Recent Developments, Mergers & Acquisitions, and Expansion Plans

Chapter 8 Global Medical Polypropylene Market, by Type

- 8.1 Global Medical Polypropylene Market Value, by Type (2021-2035)

- 8.1.1 Type I

- 8.1.2 Type II

Chapter 9 Global Medical Polypropylene Market, by Application

- 9.1 Global Medical Polypropylene Market Value, by Application (2021-2035)

- 9.1.1 Application I

- 9.1.2 Application II

Chapter 10 North America Medical Polypropylene Market

- 10.1 Overview

- 10.2 North America Medical Polypropylene Market Value, by Country (2021-2035)

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 North America Medical Polypropylene Market Value, by Type (2021-2035)

- 10.3.1 Type I

- 10.3.2 Type II

- 10.4 North America Medical Polypropylene Market Value, by Application (2021-2035)

- 10.4.1 Application I

- 10.4.2 Application II

Chapter 11 Europe Medical Polypropylene Market

- 11.1 Overview

- 11.2 Europe Medical Polypropylene Market Value, by Country (2021-2035)

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Spain

- 11.2.5 Italy

- 11.2.6 Russia

- 11.2.7 Rest of Europe

- 11.3 Europe Medical Polypropylene Market Value, by Type (2021-2035)

- 11.3.1 Type I

- 11.3.2 Type II

- 11.4 Europe Medical Polypropylene Market Value, by Application (2021-2035)

- 11.4.1 Application I

- 11.4.2 Application II

Chapter 12 Asia Pacific Medical Polypropylene Market

- 12.1 Overview

- 12.2 Asia Pacific Medical Polypropylene Market Value, by Country (2021-2035)

- 12.2.1 China

- 12.2.2 Japan

- 12.2.3 India

- 12.2.4 South Korea

- 12.2.5 Australia

- 12.2.6 Southeast Asia

- 12.2.7 Rest of Asia Pacific

- 12.3 Asia Pacific Medical Polypropylene Market Value, by Type (2021-2035)

- 12.3.1 Type I

- 12.3.2 Type II

- 12.4 Asia Pacific Medical Polypropylene Market Value, by Application (2021-2035)

- 12.4.1 Application I

- 12.4.2 Application II

Chapter 13 Latin America Medical Polypropylene Market

- 13.1 Overview

- 13.2 Latin America Medical Polypropylene Market Value, by Country (2021-2035)

- 13.2.1 Brazil

- 13.2.2 Argentina

- 13.2.3 Rest of Latin America

- 13.3 Latin America Medical Polypropylene Market Value, by Type (2021-2035)

- 13.3.1 Type I

- 13.3.2 Type II

- 13.4 Latin America Medical Polypropylene Market Value, by Application (2021-2035)

- 13.4.1 Application I

- 13.4.2 Application II

Chapter 14 Middle East & Africa Medical Polypropylene Market

- 14.1 Overview

- 14.2 Middle East & Africa Medical Polypropylene Market Value, by Country (2021-2035)

- 14.2.1 Saudi Arabia

- 14.2.2 UAE

- 14.2.3 South Africa

- 14.2.4 Rest of Middle East & Africa

- 14.3 Middle East & Africa Medical Polypropylene Market Value, by Type (2021-2035)

- 14.3.1 Type I

- 14.3.2 Type II

- 14.4 Middle East & Africa Medical Polypropylene Market Value, by Application (2021-2035)

- 14.4.1 Application I

- 14.4.2 Application II

Chapter 15 Company Profiles and Market Share Analysis: (Business Overview, Market Share Analysis, Products/Services Offered, Recent Developments)

- 15.1 Proxy Biomedical

- 15.2 Dow

- 15.3 DuPont

- 15.4 Basf

- 15.5 Lanxess

Report ID:

163

Published Date:

April 2025

Trusted by more than 10,500 organizations globally

Infaluble Methodology

Customization

Analyst Support

Targeted Market View